Tim Cook is “afraid of [the] shareholder blowback” that might come with buying a Hollywood studio, claims one executive, quoted in a new story from the Hollywood Reporter.

The article, published Wednesday, suggests that Apple missed out on buying MGM Studios because it wasn’t bold enough to do so. Amazon recently snapped up MGM, home of the James Bond movies, for a massive $8.45 billion. Apple was supposedly in the bidding at some point, but didn’t wind up going through with it.

Because Tim Cook’s chicken. Or something.

“Apple has made a major strategic mistake not buying a Hollywood studio while Amazon, Disney, Netflix and others run away with content,” Wedbush analyst Dan Ives is quoted as saying in the article. “Content is king, and Apple built a mansion with hardly any furniture in it. MGM was a no-brainer acquisition for Apple, and they missed a huge opportunity.”

Hal Vogel, CEO of Vogel Capital Management, said that Cook is “afraid of shareholder blowback if he goes Hollywood in a big way.”

Blowback from shareholders

What would have happened to Apple’s stock price, and shareholder response, had it bought MGM is, of course, impossible to know. The massive purchase didn’t really do much at all to Amazon’s share price, nudging it up only around $6 per share — an approximately 0.2% gain. Plenty have already questioned the wisdom of buying MGM for so much money. MGM was Amazon’s second biggest-ever purchase, after spending $13.7 billion on Whole Foods in 2017. (Amazon’s share price increased 1.38% following that news, although Whole Foods’ share price soared.)

Apple, for its part, doesn’t really buy name companies like some of its Silicon Valley rivals. While there is the odd example of a Beats or Intel’s modem business sprinkled in among the purchases, most are smaller companies whose functionality is then baked into future Apple products. Apple may be worth more than Amazon, but it’s very cautious when it comes to the big deals. Case in point: The $3 billion Beats deal is Apple’s biggest-ever purchase.

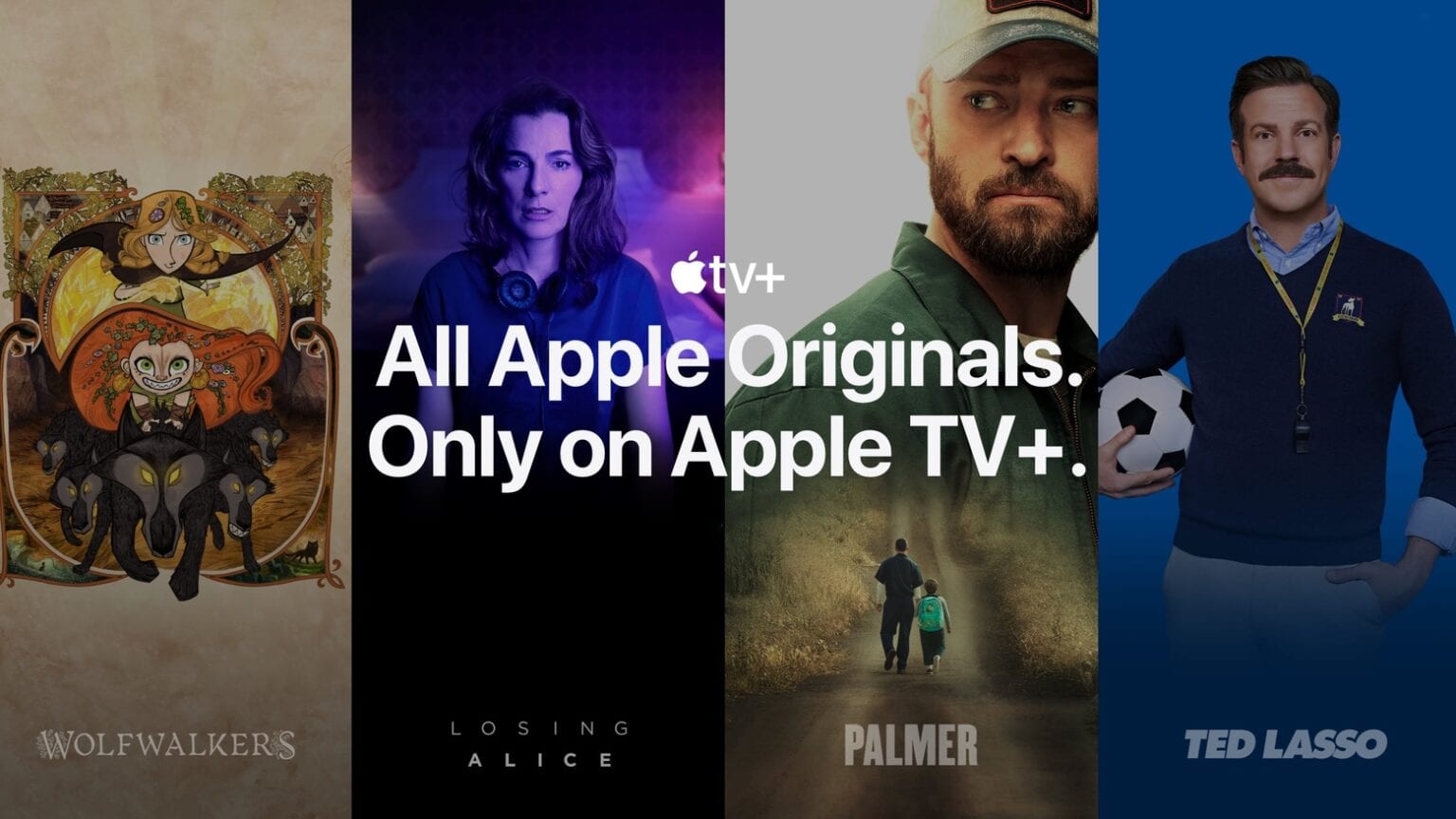

Apple has spent plenty of money on Apple TV+, but it remains a money-losing business for the Cupertino giant. It’s hardly a “hobby” like Apple famously said when it launched its Apple TV set-top boxes, but it’s certainly not the main focus of its energy. Apple is, instead, building its properties from the ground up.

The Hollywood Reporter article cites Morgan Stanley as saying that only 8% of respondents to its research said they use Apple TV+. That’s far behind the 58% who use Netflix, the 45% who use Amazon Prime, and the 31% who use Disney+.

Which studios are left to buy?

Of course, a valid question is: Which studios would be left if Apple did want to buy one? The article suggests that:

“Apple could choose to ramp up its Hollywood division with a mega buy of a studio the size of, say, Lionsgate, which gets mentioned as a possible takeover target given its relative lack of scale — Lionsgate’s market cap is $3.8 billion, while Apple’s is $2.1 trillion — as well as its 17,000-title library and film and TV franchises like Hunger Games, Twilight and its Starz drama Power.”

The question, though, is whether it will happen. Based on Apple’s history, and strategy when it comes to acquisitions, I’d suggest it won’t. Whether that’s a massive mistake remains to be seen from how much the likes of Amazon manage to get out of MGM. If the last year has proven anything, it’s that the entertainment industry is a fickle and difficult one. Maybe Apple’s right to play it cautious.

Source: Hollywood Reporter