Although Apple’s December 2022 quarter was something of a disappointment, thanks to declines in revenue and profits, company executives accentuated the positives whenever possible during an earnings call with investors on Thursday.

Here are some upbeat developments coming out of Apple’s Q1 2023 financial results, including a significant milestone in active users and a big jump in iPad revenue.

1. Say goodbye to supply chain problems

Apple faced a triple whammy last quarter, Apple CEO Cook said. The three bogeymen included “foreign exchange headwinds,” aka the strong dollar’s impact on Apple’s international business. (Horizon Investments explains this financial headache well: “When the dollar rises relative to other currencies, U.S. multinational companies’ earnings from overseas are worth less when they get converted from foreign currencies into dollars.”)

The second problem was disruptions caused by COVID-19 and the resulting lockdowns and protests in China, where Apple manufactures the bulk of its products.

The third factor was “a challenging macroeconomic environment as the world continues to face unprecedented circumstances, from inflation to war in Eastern Europe, to the enduring impacts of the pandemic.”

While the dollar remains strong and the war in Ukraine shows no sign of letting up, the pandemic’s effects seem to be lessening around the world. And most importantly, Cook said the major manufacturing hiccups that plagued Apple in late 2022 now look like a thing of the past.

“From a supply chain point of view, we’re now at a point where production is what we need it to be. And so the problem is behind us,” Cook said. — Lewis Wallace

2. Apple sticks to its positive-outlook guns

After outlining the three main limiting factors on revenue this quarter — the “triple whammy” outlined above — Cook remained almost defiantly positive in his outlook.

After describing the third and most nebulously ominous constraint — macroeconomic woes globally — Cook said, “We know Apple is not immune to it.”

“But whatever conditions we face, our approach is always the same. We are thoughtful and deliberate,” he continued. “We manage for the long term, we adapt quickly to circumstances outside our control, while delivering with excellence in the things we can. We invest in innovation in people and in the positive difference we can make in the world.”

And what is that if not a perfect segue to talking about all the products Apple customers know and love?

“And we do it all to provide our customers with technology that will enrich their lives and help unlock their full creative potential. It’s a wonderful thing to be a part of,” he said. — David Snow

3. Apple’s base of active users surpasses 2 billion

Apple’s installed base has exceeded two billion active devices, as revealed by Tim Cook during today’s financial earnings call. In his opening remarks, he revealed that just seven years after passing one billion active devices, Apple has doubled that figure.

Cook cited “our deep commitment to innovation, incredible customer loyalty and satisfaction and a large number of switchers” as reasons for their success.

The milestone’s value goes beyond bragging rights. The more iPhone, Mac and iPad users there are, the more potential customers for Apple services there are. — D. Griffin Jones

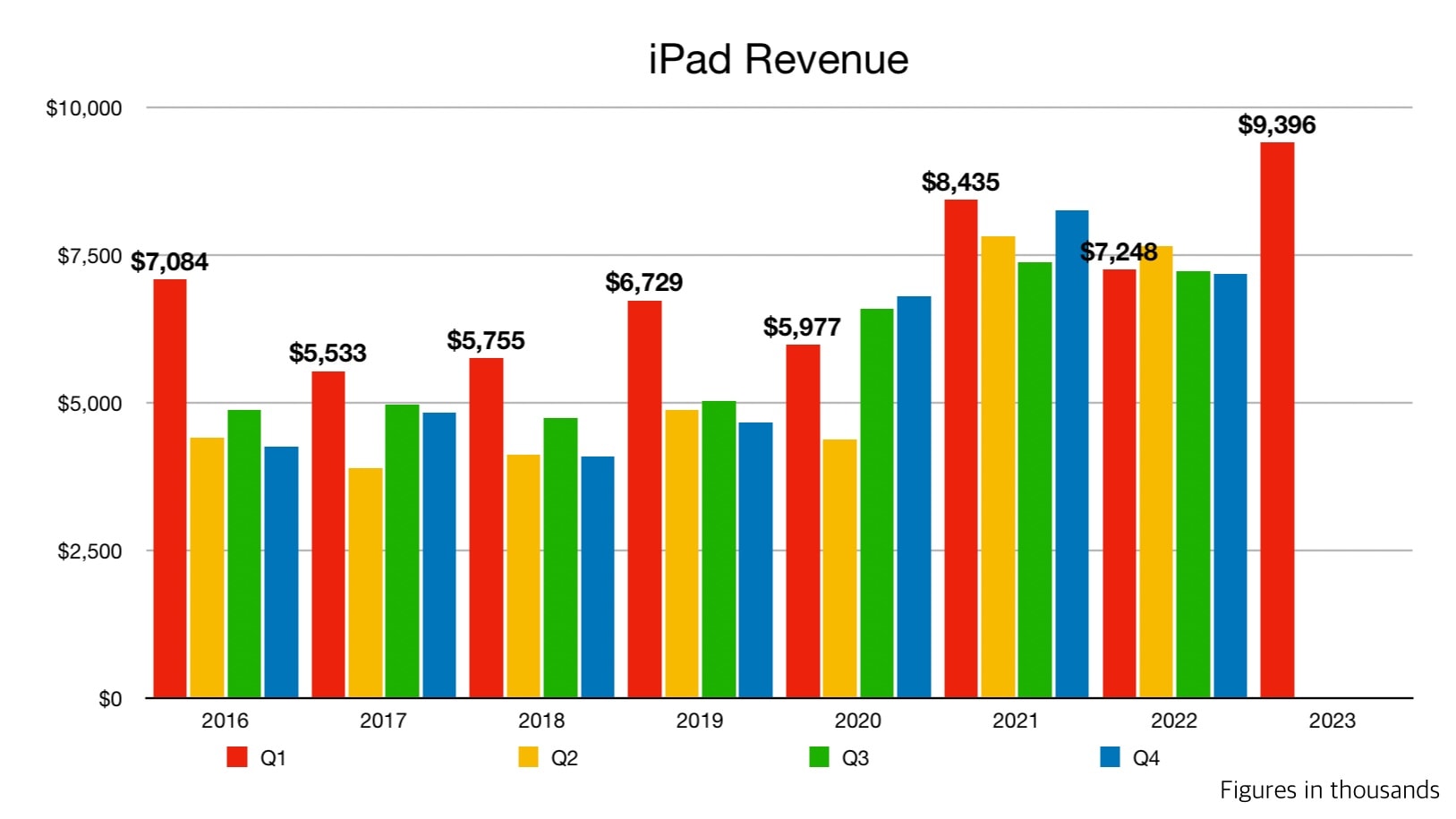

4. iPad is a definite bright spot

If all Apple’s product segments had done as well as iPad, the company would have had its best quarter ever. Revenue from tablet shipments increased a whopping 30% year over year during the December 2022 quarter. It totaled $9.4 billion, more than iPad has ever generated in any quarter.

Chart: Ed Hardy/Cult of Mac

In fall 2022, Apple introduced an iPad Pro updated with a faster processor, as well as a redesigned basic iPad with a larger display.

“Customers continue to praise our new lineup for its versatility, whether it’s the new iPad Pro, now powered by the M2 or the newly designed iPad 10th generation with its stunning liquid Retina display and beautiful colors,” said Cook. — Ed Hardy

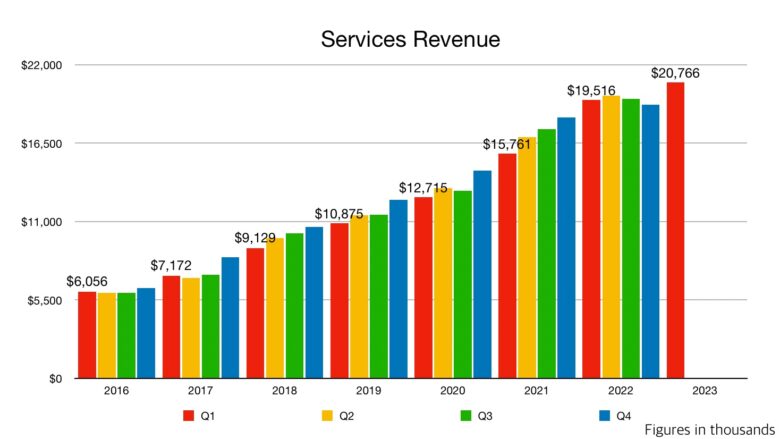

5. Apple’s services snowball continues to swell

Tim Cook’s shrewd strategy of focusing on services for revenue growth continues to pay off handsomely for Cupertino. “Moving to services, we generated $20.8 billion in revenue, a new all-time record in total and for many services offerings,” said CFO Luca Maestri.

Transactions processed through Apple Pay and subscriptions to things like Apple TV+ just keep growing. “We now have more than 935 million paid subscriptions across the services on our platform, up more than 150 million during the last 12 months alone, and nearly four times what we had just five years ago,” Maestri said. — Lewis Wallace

Chart: Ed Hardy/Cult of Mac

Bonus: Understanding Apple financial results requires knowing 2 terms

The curse of the ‘challenging compare’

A major reason Apple’s stock price took a hit after today’s earnings release is that Wall Street always wants three things: Growth, growth and more growth. That myopic focus means Apple’s incredible success last year — when the company set record after astonishing record like some kind of juiced-up Olympic athlete — hurts it this time around.

For instance, the previous year’s mega-hit laptops made last quarter — which was devoid of new Macs — look extra-anemic. “We had a difficult compare because this time last year we had the extremely successful launch of the redesigned M1 MacBook Pros,” Cook said.

Can a company enjoy too much success? No, but Apple’s extreme success in previous quarters definitely clouded today’s results. — Lewis Wallace

Call sees surge in references to ‘constant currency basis’

Unlike on recent earnings calls, this time Cook and CFO Luca Maestri referred numerous times to revenue figures considered on a “constant-currency basis” against strong foreign exchange-rate headwinds.

A “constant currency” is a fixed exchange rate used to remove the impact of exchange-rate fluctuations on financial performance numbers needed for financial statements.

Apple and other companies with large international operations tend to use constant-currency numbers to put a different spin on the harder figures they’re required to report.

Find constant currency, headwinds and many more terms in our earnings-call glossary!–David Snow